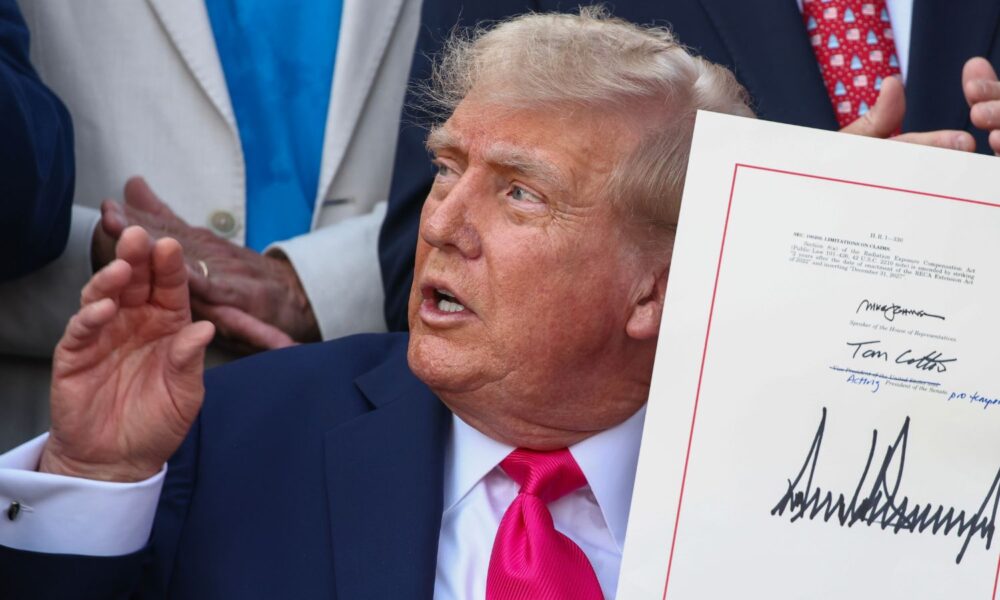

In July, President Trump signed into law the spuriously-named “One Big Beautiful Bill Act” (OBBB), a sprawling budget package with severe and far-reaching impacts, from restricting healthcare access, to slashing nutrition assistance, to exploding the national deficit, to impeding the deployment of clean energy solutions.

The OBBB’s energy-related provisions could not come at a worse time for the electricity system, or the people, businesses, and critical infrastructure relying upon it.

Energy bills are soaring, aging power plants are retiring, an underinvested grid is faltering, and electricity demand is newly surging, particularly as a result of AI-driven data center buildout.

The Trump administration is actively exacerbating the electricity system’s challenges by unilaterally halting construction of nearly completed clean energy projects, yanking support of permitted grid infrastructure and pulling billions in funding for more, imposing steep—and shifting—tariffs on vital energy system inputs, and explicitly restricting permitting of wind- and solar-powered generation projects.

Instead of countering these attacks and delivering urgently needed solutions, however, the OBBB—written and passed along partisan lines—cuts a similar path. Again and again, the OBBB makes changes to existing energy policies to restrict access to, and hike the costs of, the fastest, cheapest, and cleanest resources to deploy: wind, solar, batteries, grid infrastructure, and energy efficiency.

As a result, the OBBB’s energy implications are severe:

- Electricity rates will increase, on the order of 10 to 18 percent by 2035;

- Renewables deployment will decrease, on the order of 57 to 62 percent over the next 10 years;

- Grid reliability will be strained, as electricity demand surges while electricity supply solutions are held back;

- Clean energy jobs will be lost, with the solar industry alone warning of the potential for hundreds of thousands of jobs lost over the next few years;

- Advanced manufacturing will be undermined, putting hundreds of billions of dollars of forward-looking investments at risk;

- Global leadership in innovation will be ceded, as the government pulls investments in pioneering research, development, and deployment in the technologies of the future; and

- Emissions reductions will slow, primarily by prolonging the use of coal and increasing the use of gas in the power sector, abandoning energy efficiency initiatives, and slowing the shift to electric vehicles.

Below, a closer look at the specific policy changes that are driving these impacts, with particular attention to the revised clean electricity tax credits given their outsized impact.

Clean Electricity Tax Credits (45Y/48E)

The OBBB’s single most impactful change to energy policy is its massive revision of the clean electricity tax credits (also sometimes referred to by their place in the tax code, sections 45Y and 48E). Tax policy has been extraordinarily effective in helping to drive clean energy deployment; updates passed in 2022 further strengthened its potential. First, the tax credits were made technology-neutral, meaning any type of electricity resource could access the same credits so long as it met an emissions eligibility threshold. Second, credit phase out was tied to either 2033 or the electricity system meeting overall emissions-reduction targets, whichever date comes later, thereby providing investors with needed long-run market certainty while anchoring the incentive to achieving clear—and directly related—policy goals.

The OBBB attacks both of these foundational points, restricting eligibility of certain technologies and abruptly upending that vital long-run market certainty.

- Severe restrictions on wind and solar: Wind and solar resources are explicitly targeted for rapid tax credit phase-out through two changes: howthese resources can qualify for the tax credit and dramatically shortening for how longthey can qualify.

- Projects beginning construction by July 4, 2026: For one year following bill passage, wind and solar projects can still access the tax credit based on when they begin construction.

- Note: In reality, this brief one-year window is even more constrained; just days after signing the law, President Trump issued an executive order directing the Treasury Department to narrow the long-standing definition of “begin construction”—which Treasury then did, further limiting wind and solar projects’ ability to qualify for safe harbor provisions.

- Projects beginning construction after July 4, 2026: For all wind and solar projects beginning construction after July 4, 2026, project eligibility is switched from when the project begins construction to when a project is placed in service, with a deadline of the end of 2027. This is a calamitous change for complex projects—especially wind, but also some solar—that can take years to plan, permit, construct, and fully enter into service, meaning for many wind and solar projects, the credit effectively closes with the July 2026 transition.

- Projects beginning construction by July 4, 2026: For one year following bill passage, wind and solar projects can still access the tax credit based on when they begin construction.

- Broader 45Y/48E credit phase-out: Separate from the rapid wind and solar credit phase-out, the remainder of the clean electricity tax credits—including for battery storage projects—are phased out beginning in 2034, with the OBBB striking the alternative emissions reduction phaseout timeline, which had been anticipated to stretch many years longer. For these projects, eligibility remains tied to the beginning of construction.

- “Prohibited Foreign Entity” rules: In addition to faster phase-outs, the OBBB also adds complex foreign entity restrictions for projects to navigate beginning in 2026, including restrictions on the supply chain of materials and components used in projects, the ownership of projects, and the financing of projects. These rules are intended to limit prohibited foreign entities—namely, China, Russia, Iran, and North Korea, as well as other specified foreign entities—from benefitting directly or indirectly from the credits. In practice, however, the restrictions threaten to be so entirely unworkable as to effectively render the impacted credits unusable.

- New loophole for fuel cells: The OBBB carves out a loophole specifically for fuel cells, allowing them to access the full 30 percent investment tax credit without regard for the emissions threshold requirement—the fundamental prerequisite of technology-neutral clean electricity tax credits. Critically, fuel cells running on natural gas can have high carbon dioxide emission rates, meaning they are nowhere near “clean” and would never qualify without this new loophole.

Impact

Following the 2022 updates to the clean electricity tax credits, studies repeatedly found that these incentives had the potential to drive enormous amounts of renewable energy onto the grid over the next decade-plus, helping to hold down electricity costs and ease supply constraints—exactly as the moment demands.

Post-OBBB changes, however, analyses are now finding that wind, solar, and storage deployment could be dramatically curtailed over the coming decade and beyond—exactly the opposite of what the moment demands.

For example, Energy Innovation, a nonpartisan think tank, forecasts a staggering 340 gigawatt (GW) decrease in generation capacity added to the system over the next decade, led by approximately 200 GW less wind, 150 GW less solar, and 17 GW less battery storage—plus 19 GW more of natural gas capacity than would have otherwise occurred. Numerous additional studies find similarly massive contractions in anticipated clean deployment.

Tighter electricity supply, plus increased costs for the generation that still gets built, plus higher natural gas prices because of increased fossil gas use, all lead to muchhigher electricity costs. By Energy Innovation’s estimate, compared to a pre-OBBB scenario, electricity prices could increase 25 percent by 2030 and 74 percent by 2035, translating to electricity rate increases of 10 to 18 percent by 2035.

When sky-rocketing electricity demand is layered on top, something has to give: either electricity growth is slower—meaning constrained AI development, as well as constrained opportunities for new manufacturing and rapid electrification of end uses—or it all still happens, just at a much higher cost, paid for in higher electricity bills.

Consumer-Facing Tax Credits

In addition to slashing incentives for larger-scale renewables deployment, the OBBB also slashed consumer-facing opportunities to participate in the clean energy transition, including through investments in rooftop solar, energy efficiency and weatherization, and electric vehicles—except here, the OBBB cuts are even more severe:

- Residential clean electricity (25D): This credit allows people to claim refunds equivalent to 30 percent of system costs for residential clean energy investments, including rooftop solar, batteries, small-scale wind, and geothermal heat pumps. The credit had been set to start phasing out in 2033; the OBBB imposed an abrupt end date of December 31, 2025.

- Energy efficiency (25C, 45L, 179D): These credits incentivize energy efficient construction, appliances, and building upgrades in homes and commercial buildings. The credits had been set to phase out at the end of 2032 (or were permanent, in the case of 179D); the OBBB imposed abrupt end dates of December 31, 2025, for 25C, and for projects beginning construction after June 30, 2026, for 45L and 179D.

- Clean vehicle and charging tax credits (30D, 25E, 30C): These credits facilitate the purchase of new (30D) and used (25E) clean vehicles and the deployment of charging infrastructure. The credits had been set to phase out at the end of 2032; after changes in the OBBB, the vehicle credits are now already expired, with the law forcing an end date of September 30, 2025, and the charging credits will be terminated for projects placed in service after June 30, 2026.

Impact

These rapid phase-outs hit hard on two fronts.

First, they significantly undermine the transition to cleaner energy sources and cleaner and more efficient energy uses at the consumer level—exactly when the electricity system should be maximizing investments in energy efficiency and encouraging the uptake of distributed energy resources. Post-OBBB changes, however, people will be stuck with higher energy bills or paying more out-of-pocket to make changes, and the grid will be more strained than it otherwise would because of forfeited opportunities for efficiency, which has the net effect of further driving up system costs—and therefore consumer costs as well.

Second, these rapid phase-outs undermine the broader growth in the clean energy economy that was spun up to meet anticipated demand, ranging from small businesses all the way to billion-plus dollar manufacturing facilities. Now, the critical long-run market certainty that these investments had been predicated on is upended and many of those jobs, investments, and plans are already being lost.

Advanced Manufacturing Production Credit

The advanced manufacturing production credit (45X) was created in 2022 to incentivize the domestic production of the components used in clean technologies, including solar, wind, and battery components; inverters; and critical minerals. When passed, 45X was slated to phase out beginning in 2030 except for critical minerals, which did not have a phase-out date.

The OBBB preserved some elements of 45X, but also made numerous changes:

- Ends credits for wind energy components after 2027;

- Adds metallurgical coal—which is overwhelmingly exported—as a covered critical mineral through 2029;

- Adds a phase-out date for other critical minerals, now beginning in 2031;

- Maintains the previous phase out period, 2030 to 2032, for all other components; and

- Layers on numerous and complex prohibited foreign entity restrictions.

Impact

Manufacturing investments skyrocketed in the aftermath of the Inflation Reduction Act in 2022, which powerfully used policies spurring supply and demand to help the US boost its development of domestic clean energy manufacturing and supply chains. Now, the OBBB is undermining both sides of the equation, and already tens of billions of dollars of project cancellations are stacking up as a result.

Beyond slashing investments, this cuts jobs and paychecks, as well as undermines efforts to limit the country’s risky dependencies on geopolitically fraught supply chains. These changes also have the long-tail effect of undermining US leadership in the development of forward-looking technologies.

Clawing Back Climate and Clean Energy Funds

In addition to making major changes to energy tax incentives, the OBBB also ransacked numerous existing grant and loan programs intended to support research through deployment of clean energy technologies, as well as transparency and solutions around the presence of, and harms from, fossil fuel pollution.

Most of the OBBB changes constituted the clawing back of “unobligated” program funds, which includes funds that have not yet been awarded as well as funds that have been awarded but not yet fully contracted. Separately, the administration is attempting to also claw back funds that have already been obligated, including the Greenhouse Gas Reduction Fund—a subject of ongoing litigation. If the administration succeeds, then those “de-obligated” funds could potentially be rescinded, too.

Of the many programs subject to rescissions under the OBBB, two key areas of impact stand out:

- Slashing DOE’s loan programs, repurposing what remains: The OBBB did not fully dismantle the Loan Programs Office (LPO) but it did severely hamstring it by rescinding credit subsidies, in whole or in part. This means even where substantial loan authority remains, the LPO is majorly constrained in its ability to actually use that authority to advance innovative and forward-looking solutions in clean energy, electricity infrastructure, vehicles, and projects in tribal communities. Furthermore, the OBBB repurposed the Energy Infrastructure Reinvestment Program, by far the largest LPO program with $250 million in lending authority, to be the “Energy Dominance Financing” program, struck its requirements for projects to reduce emissions and analyze community impacts, and added requirements that threaten to exclude wind and solar.

- Cutting grants for community-based programs: The OBBB rescinded billions of dollars in funding for programs intended to increase access to, and uptake of, clean energy solutions, as well as help communities identify and mitigate sources of pollution harms. These programs—such as the Greenhouse Gas Reduction Fund, Climate Pollution Reduction Grants, and Community Change Grants—were especially notable for the degree to which they attempted to support environmental justice and local solutions for local problems, including for low-income and disadvantaged communities who have long been overlooked.

These programs, as well as parallel programs focused on jump-starting industrial decarbonization, were important for their ability to reach the people and projects where tax policy has limited effectiveness and regulatory gaps remain. Moreover, they were often specifically intended to catalyze significantly more capital, and significantly more projects. The loss in grant funding and loan authority is, therefore, many times greater than the dollar amounts.

There is also the fact that cutting off these programs now fully undermines the capacity and expertise developed to support these programs and communities, as well as the additional capital already committed in response.

The enormity of wasted time, wasted money, and worst of all, wasted opportunity, is staggering.

Additional Energy Policy Changes

Alongside revisions to the major clean energy tax incentives, the OBBB also inserted changes to multiple other pieces of energy tax policy either directly or indirectly related to the power sector, including:

- Credit for carbon capture (45Q): The 45Q credit provides a subsidy for capturing carbon dioxide from polluting industrial facilities and fossil fuel-fired power plants, and a higher incentive for direct air capture. Previously, 45Q assigned greater value to projects that directed carbon dioxide to long-term storage; the OBBB modified the credit such that carbon dioxide that is subsequently reused or deployed for enhanced oil recovery—ultimately meaning more carbon dioxide produced—can now receive the same high value. The OBBB did not change the credit phase out, which is set to sunset after 2032, but it did add complex foreign entity restrictions, beginning in 2026.

- Credit for existing nuclear power production (45U): The 45U credit, created in 2022, is specifically intended to provide limited economic support to existing nuclear power plants, varying based on economic need. The OBBB retained the 2032 sunset date, but added restrictions related to prohibited foreign entities (excluding nuclear fuels).

- Credit for clean hydrogen production (45V): The 45V tax credit, also launched in 2022, is intended to support the production of clean hydrogen. The OBBB did not change the credit’s underlying framework; however, it drew forward the credit phase-out from projects beginning construction after 2032 to projects beginning construction after 2027.

Separately, the OBBB added numerous plus-ups for fossil fuels, including lowering royalty rates; mandating coal, oil, and gas lease sales; expediting fossil-based project permitting, including pay-to-play provisions; and removing fees penalizing methane pollution from oil and gas operations. Together these changes make it easier, quicker, and cheaper to extract, transport, and use fossil fuels. When combined with all the cuts to clean energy initiatives, the pro-fossil, anti-renewable effect is magnified.

Raising Costs, Losing Jobs, Slashing Investments, Increasing Emissions, Ceding Leadership

The OBBB is a sprawling law with impacts stretching far beyond energy and climate. But its attacks on forward-looking climate and clean energy policies mirror many of the additional provisions in the law, which again and again and again result in an overall shift in resources away from the people and priorities who need it most.

Now, because of the OBBB’s relentless attacks on proven energy policies working to drive the country’s energy system forward, everyone from individuals to communities to entire industries will be forced to pay a towering price, from higher energy bills, to lost jobs, to cancelled investments, to increased pollution, to ceded technological leadership, to undermined resilience in the face of a rapidly evolving climate and a rapidly evolving economy.