Louisiana residents already pay high electric bills for a very unreliable power grid that just recently left nearly 100,000 Louisianans in the dark due to electricity shortages. And now, the state’s largest utility company is trying to get approval for a project that could have major negative consequences for both grid reliability and affordability, with very little transparency to the people who would be most impacted.

If you want to weigh in on your local utility company’s planned investments, and the resulting increases of your utility bills, you may face a number of procedural barriers to public participation depending on what state you live in. And the utility companies may have incentives to keep certain information from the public if they know that information would lead to higher scrutiny of their investment plans.

What’s happening in Louisiana is an extreme example of this corporate obfuscation. Here’s what you need to know.

Entergy’s opaque and costly gas plant proposal for Meta data center

Entergy Louisiana, the state’s largest utility company, is seeking approval from the Louisiana Public Service Commission (“LPSC” or “Commission”) to spend more than $3.7 billion on three new power plants and other related infrastructure. This infrastructure is proposed to power a massive new data center—think roughly 70 football fields—planned for development in North Louisiana by a subsidiary of Meta, the parent company of Facebook, WhatsApp, and Instagram.

The three power plants would be fueled by methane gas, a potent fossil fuel. The gas plants would total nearly 2,300 megawatts to help power the roughly 2,600-MW Meta data center (though it may be planned to be larger than this by now). For context, the City of New Orleans’ peak summer demand in 2023 was about 1,200 MW (see Table 2 of Appendix B here), so the Meta data center would draw more than twice the maximum power consumption of the state’s largest city. And because the data center will run so frequently, the annual energy consumption will likely exceed three times that of New Orleans.

The Union of Concerned Scientists (UCS) and Louisiana-based Alliance for Affordable Energy (AAE) are intervenors in this LPSC case, with Earthjustice as legal counsel. As is typical in these types of state regulatory cases, the intervenors signed non-disclosure agreements (NDAs) agreeing not to publicly talk about any information marked as confidential.

However, even after signing NDAs, there is still a mountain of information neither AAE nor UCS has seen, let alone the Louisiana public. Entergy wanted this information to have a higher tier of confidentiality called “Attorney’s Eyes Only” (AEO), essentially meaning the only people permitted to view some of the most pertinent information are the lawyers and expert witnesses in the case. In fact, everyone who signed the NDA gets to view the AEO-confidential materials except for 10 individuals, and the vast majority of those people are non-profit representatives.

Witnesses submitted expert testimony on behalf of AAE and UCS last month, and the public versions contain alarming analysis about the wide array of risks posed by the gas plant proposal, which I will get into. But what’s perhaps even more astonishing is the amount of information that is redacted from the testimony, due to how much of it was deemed by Entergy to be commercially sensitive and confidential.

Entergy has signed a contract with Meta to supply electricity to the data center for 15 years. The utility company says Meta will be paying for a “substantial portion” of the roughly $3.2 billion in gas plant costs, but only if another 15-year contract is signed for power supply through 2056. If Meta doesn’t re-sign, or walks away from the first contract early, Louisiana ratepayers will be left to foot the bill for the unneeded gas plants.

Further, the testimony filed on behalf of AAE and UCS shows that the costs of this proposal are likely massively underestimated. In addition to the costs that could directly hit Louisianans’ wallets in the future, the experts also point out that the risks of power outages and environmental harms are seriously understated, which could add more costs outside utility bills.

Louisiana should reject the gas project as proposed

The LPSC should reject Entergy’s gas project as proposed, unless significant safeguards are attached as conditions. The long list of recommended conditions made by our expert witnesses include extending the Entergy-Meta contract length to 25 years from 15 years, to more closely align with the useful life of a gas plant and better insulate ratepayers from the data center costs. The witnesses also urge the Commission to require Entergy to better study the grid reliability risks of the proposal, accelerate the procurement of renewables, and better assess transmission needs.

In addition to implementing the AAE and UCS expert witnesses’ recommendations, Entergy should also be forced to request proposals from third-party power suppliers as alternatives to the three gas plants, as Commission policy requires. Following this process is likely to lead to cleaner, more affordable solutions for powering the data center. (An LPSC judge deferred ruling on this issue in February.)

A quick spoiler: because so much of the information is redacted, and there’s uncertainty about how long Meta will stick around, I won’t be able to tell you just how expensive this proposal could be. The Louisiana public apparently won’t know either, even though they’re the ones at risk of paying for this huge project. Nevertheless, we can still get into the unredacted details in the testimony, starting with the potential direct increases in utility bills. And if you live in Louisiana, you can reach out to your Public Service Commissioner and demand better transparency and protections.

The details: an expensive moving target

Entergy filed its initial application for this project in October 2024. Around the time the Institute for Energy Economics and Financial Analysis (IEEFA) filed its testimony on behalf of AAE and UCS last month, the utility company was still negotiating the terms of its 15-year power supply contract with Meta. And in February of this year, Entergy told the Commission that Meta was increasing the load of its planned data center by a redacted number of megawatts.

The IEEFA testimony points out that this moving-target approach exposes ratepayers to additional risks and that the Commission should review the final terms of the contract with Meta before deciding on Entergy’s proposal. Notably, Entergy is claiming that it doesn’t need the Commission’s approval of the contract at all, which would be unlike the processes in many other states.

The testimony estimates that Entergy customers could be on the hook for “hundreds of millions, if not billions of dollars” in additional costs associated with powering the data center, contrary to the utility’s claim that ratepayers would be mostly insulated from such costs. But again, the specifics are being kept from the public because Entergy has deemed them confidential.

Entergy’s proposal to power Meta’s data center will potentially shift large costs to the Louisiana public, but many details have been redacted and kept out of public view. | Source: IEEFA testimony on behalf of AAE and UCS. | “Laidley” is the Meta subsidiary seeking to build the data center. “ESA” is the 15-year electric service agreement between Entergy and Laidley. “ELL” is Entergy Louisiana LLC, the formal name for the utility company.

One of Entergy’s main arguments for why this gas project is beneficial to all ratepayers, and not just a trillion-dollar company like Meta, is that even if Meta closes shop after 15 years, the gas plants will still be needed in the 2040s to replace other fossil fuel plants that are set to retire. But this claim is poorly justified and not supported by capacity expansion modeling or any other type of rigorous analysis. The testimony points out the significant risk of the gas plants becoming “stranded” (in other words, essentially worthless) assets in the 2040s, with ratepayers saddled with about half of the initial capital costs on their utility bills.

Entergy and Meta’s plan risks major power outages in North Louisiana

As mentioned above, Louisiana’s power grid is unreliable compared to most other states due to a variety of factors including extreme weather and a low level of transmission capacity and non-gas-fired capacity that would make the grid more resilient to extreme weather. This proposal by Entergy to power Meta’s city-sized data center could make electricity service in the state even less reliable.

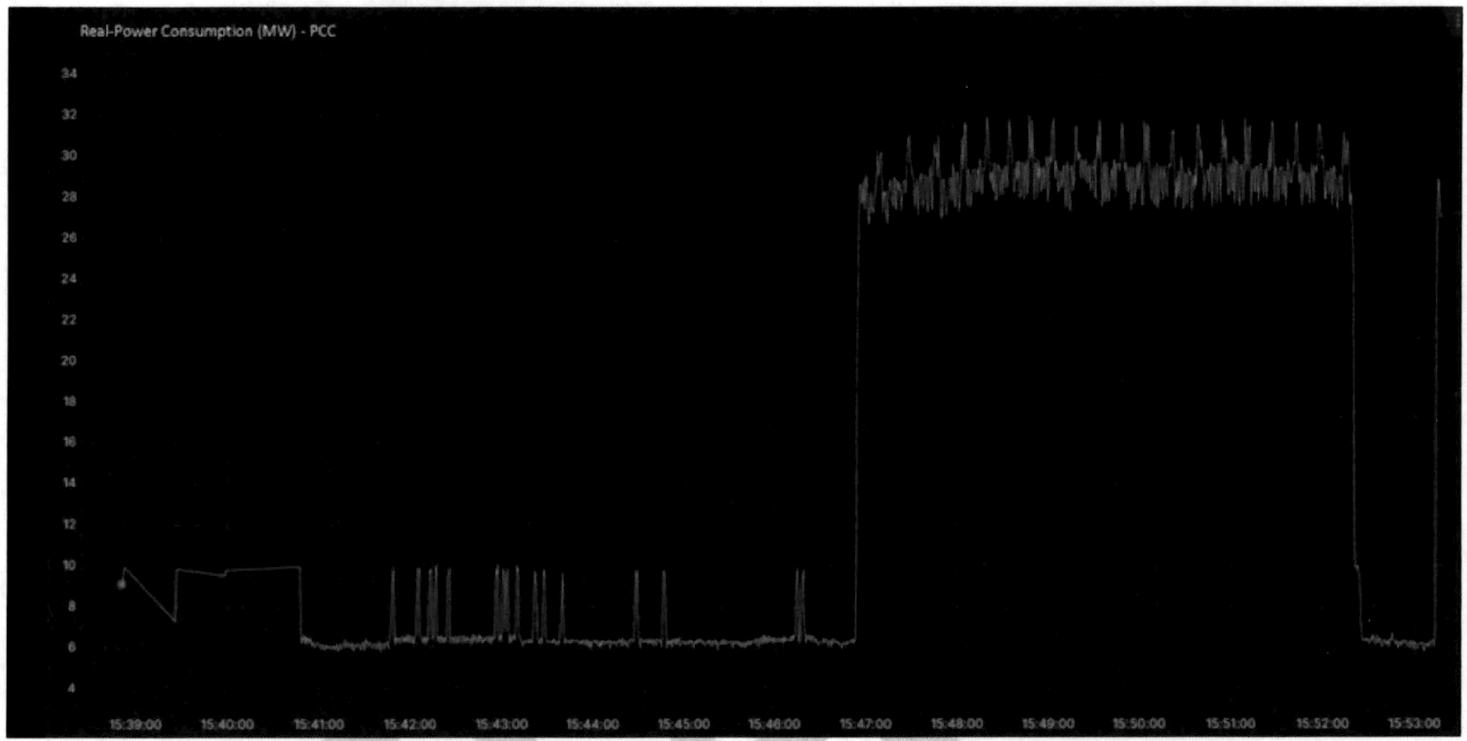

HickoryLedge, a power system engineering consultancy, also submitted testimony on behalf of AAE and UCS, pointing to several significant grid reliability problems that could arise from the gas project and data center. One of those problems is the high fluctuations in power demand that data centers can exhibit, despite having a reputation among some of demanding power at a fairly consistent level.

Data centers designed to train artificial intelligence (AI) models, such as the planned Meta data center, can exhibit large and rapid fluctuations in power demand. The above chart shows an example of 50 MW of data center load jumping from 6 MW to 30 MW in about a quarter of a second. | Source: HickoryLedge testimony, citing a working draft report by Elevate Energy Consulting.

The testimony warns that because this data center would be so large, these fluctuations could cause instability on the power grid, risking “major disruptions” to electric service in North Louisiana and possible equipment damage at nearby power plants, including the Grand Gulf nuclear plant, which already has safety issues of its own. The warnings echo of near-miss blackout events in Texas and Virginia in recent years, where data centers and crypto mining facilities have grown rapidly.

To avoid system stress caused by the high and potentially very dynamic data center load, Entergy may be compelled to operate the gas plants as “must-run” in the regional electricity market, as opposed to “economic.” This means the plants would generate power even when it’s not economic to do so, solely to avoid grid instability problems created by the data center.

UCS and others have extensively analyzed how costly of a practice it can be for utilities to operate their coal and gas plants as “must-run,” because there are often more affordable options in the open market. Those unnecessary costs get passed to ratepayers, and this problem is already pronounced in Louisiana.

Even if Entergy operates the plants as must-run in an effort to avoid power outages, the company cannot run the plants 24/7/365, because they will inevitably go through unplanned outages and maintenance outages, as all power plants do. The HickoryLedge testimony outlines the evidence establishing that Entergy hasn’t adequately studied or addressed these grid reliability issues, and doing so could add a currently unknown amount of costs in order to avoid even costlier power outages for Louisianans.

Environmental benefits exaggerated, ratepayer risks downplayed

Included in Entergy’s application submitted to the LPSC is a so-called corporate sustainability rider (CSR). The CSR claims to essentially create a path for Meta to pay for more sustainable electricity resources in the region, and to bring those resources online faster. Sounds good enough on its face, doesn’t it? However, the devil is in the details.

Testimony submitted on behalf of AAE and UCS by CPG Advisors shows that the CSR’s environmental benefits are likely to be far less than what Entergy claims, and ratepayers would again be exposed to additional unnecessary financial risks.

Part of the proposed plan is to have Meta pay for 1,500 MW of solar and/or solar-plus-storage projects through the new CSR mechanism. However, the CPG Advisors testimony points out the commitment from Meta to pay for these projects through this new mechanism seems to be far less binding compared to traditional approaches, like regular power purchase agreements (PPAs). If solar and storage resources continue to get cheaper, and Meta terminates its CSR contracts with these solar/storage projects, Louisiana ratepayers would be stuck paying for costs that are above the going market prices.

Entergy also proposes not to identify the full 1,500 MW of projects until 2030, suggesting that the utility isn’t taking advantage of the roughly 50,000 MW of solar and storage projects that are currently “waiting in line” in the grid-connection queue for the regional grid covering most of Louisiana, and parts of Arkansas, Mississippi and east Texas.

Ultimately, about two-thirds of the electricity that would be generated by resources procured through the CSR would come not from the solar and storage, but from a separate proposal to have Meta pay for carbon capture and storage (CCS) technology at an existing Entergy gas plant in Lake Charles, LA. This part of the proposal has its own risks and problems that the Commission, and Louisianans, should be concerned about.

The CPG Advisors testimony concludes that the CCS option is unlikely to come to fruition. Also, an engineering study for installing CCS at the plant is only in its early stages, so Entergy hasn’t provided the Commission with any cost estimates. This is troubling because if the companies ultimately move forward with this option, Meta could elect to terminate its payments to the project, which would saddle ratepayers with additional costs.

Both the environmental damages and ratepayer risks are downplayed in Entergy’s proposal, and the Commission should be taking that into account when deciding whether it’s in the public interest.

Commission must act to protect Louisianans

The time is now for the Commission to act in order to protect Louisianans from further pollution, more power outages, and further rate increases. If you live in Louisiana, you can contact your Public Service Commissioner and demand better transparency and protections from this proposal. Residents in the state deserve better, and the billion- and trillion-dollar corporations must be held accountable for the impacts caused by their business decisions.