Congress is currently debating a budget megabill—also known as the “reconciliation” bill, after the budget reconciliation procedures it will use to try to pass it—that would keep low tax rates for the highest-income households and pay for it by cutting a wide swath of public programs.

The bill is big—increasing the federal budget deficit by at least $2.4 trillion over the next decade—and when it comes to transportation, would take the country seriously backwards.

The House passed its version of the bill on May 22, and the Senate is currently writing its own version of the legislation. Here are three things to know about it:

1. Lower taxes for wealthy households, new fees and higher taxes for families that drive electric

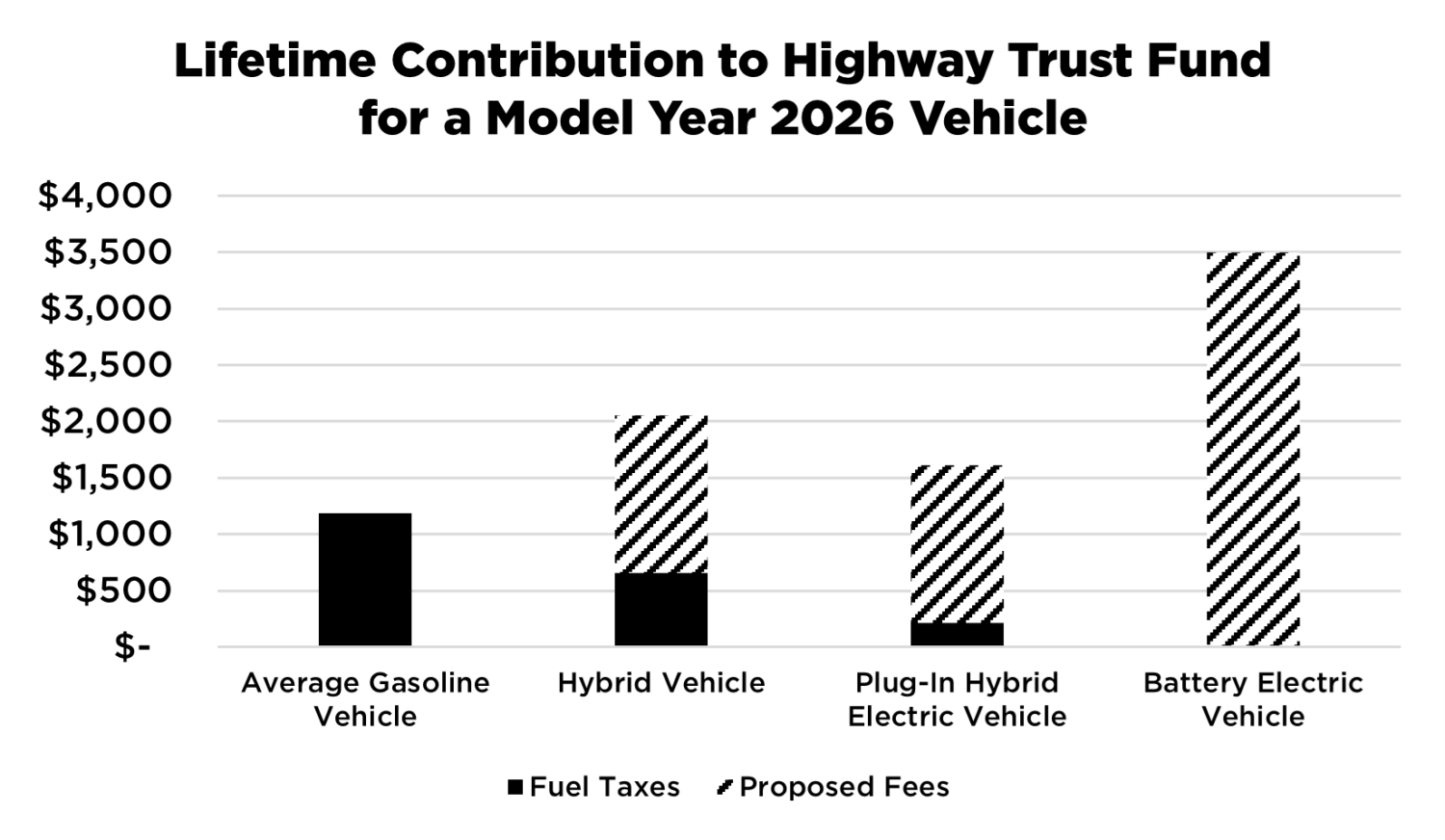

If your family owns a Chevrolet Bolt, Nissan Leaf, or Tesla, prepare to pay up. The same is true if you own a hybrid version of popular cars like the Toyota RAV4 and Camry or Honda CR-V and Accord. That’s because the bill would institute a new $250/year annual fee on electric vehicle owners and a $100/year fee for owners of hybrid cars.

These fees are supposedly meant to make up for the fact that EV drivers don’t pay gas taxes (which help fund transportation projects), but as my colleague Dave Cooke points out that’s a fallacy—EV drivers pay state and local taxes, which make up more than 80% of road funding, and into the federal general fund, which has been used to bail out the Highway Trust fund since 2008. What’s clear is that the fees would add up to much more than the average driver of a gasoline car pays in fuel taxes—nearly triple the cost, in fact.

The bill essentially kills tax credits for buying new and used electric vehicles.

As EV technology has continued to improve, automakers have brought more affordable models to market and used-vehicle inventory has grown. To pick two examples: A used 2023 Chevrolet Bolt EUV can be had in many parts of the country for under $20,000; current law allows many families a tax credit of up to $4,000 for buying a used EV. A new 2025 Chevrolet Equinox, meanwhile, has a suggested retail price just under $35,000—and is eligible for a $7,500 new-EV tax credit. The used clean vehicle tax credit would be eliminated entirely, making it harder for lower income families to switch to electric. And the new clean vehicle tax credit would be functionally killed, as my colleague Dave Reichmuth points out.

The House budget bill would also end an incentive in rural or disadvantaged areas to install an EV charger (a tax credit of 30% of the cost, up to $1,000).

2. Limited business access to clean trucks and a setback to the US transportation industry

Last month, I joined executives from companies that build and lease electric trucks and their charging infrastructure to warn against provisions in the House bill that would hurt the transition to a clean freight system.

Battery-electric trucks are one of the most cost-effective and consequential technologies we have to reduce pollution from vehicles. Take the diesel “drayage” trucks that operate near ports and transfer cargo to distribution centers. These trucks tend to be older models without modern pollution controls. Replacing a typical diesel drayage truck with an electric one is associated with hundreds of thousands of dollars in health improvements (i.e. fewer days spent in the hospital and fewer days missing work and school). And, as UCS analysis has shown, they are beginning to hit the streets in significant numbers.

But the House bill would make it harder for drivers and companies to make the switch by ending a commercial vehicle credit for clean trucks. It would also take back congressionally approved funds for the Clean Heavy Duty Program and Clean Ports Program, money that state and local governments are counting on to buy zero-emission heavy-duty vehicles, such as school buses and garbage trucks, and make improvements like shore power (which allows ships to run lighting and HVAC systems on electricity while docked, instead of idling their engines and polluting surrounding communities).

As one trucking executive put it at the press conference, “this is a Sputnik moment” for the US transportation industry. “We need some ‘Apollo 11’ energy here—not failure to launch.” And as my colleague Dr. Jessica Dunn recently wrote, other industries are closely tied to electric vehicle innovation; the future of US battery manufacturing is also at stake.

3. More money for oil companies, higher costs for drivers, and deadlier roads

The House’s version of the bill would roll back the most recent federal rules regulating vehicle fuel economy and global-warming pollution from trucks and passenger vehicles. A draft of the Senate’s version would strike the greenhouse gas rules; it would keep fuel economy standards on the books but render them useless by eliminating penalties for manufacturers who don’t comply.

Not only would this lead to billions more metric tons of heat-trapping emissions in the air, it would cost consumers more. Eliminating the global warming pollution rules would increase fuel and maintenance costs for new vehicles by $6,000 over the life of the vehicles. And if the fuel economy standards are functionally rolled back because it would be cheaper for automakers to simply not comply, drivers would see increased fuel costs by $23 billion through 2050.

Finally, the bill would rescind already-awarded “neighborhood access and equity” grants designed to make create safer transportation connections, especially in areas that are divided by dangerous highways or rail lines. Transportation for America recently listed the projects at risk. To pick one example, Portland, Maine could lose $22 million for safety improvements on local streets near Interstate 295. Across the country, over $2.4 billion could be rescinded.

Stop this backwards march on transportation

Transportation contributes more to US climate-warming emissions than any other sector of the economy. Transforming our transportation system is critical to thwarting the worst effects of climate change and protecting our health. In a megabill full of attacks on science and sound policy, the backwards march on transportation is one more reason to tell Congress no.